The Mirage Project

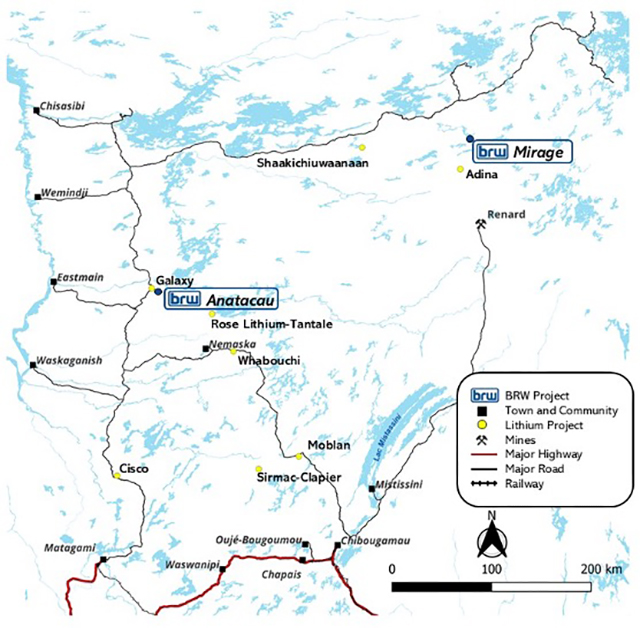

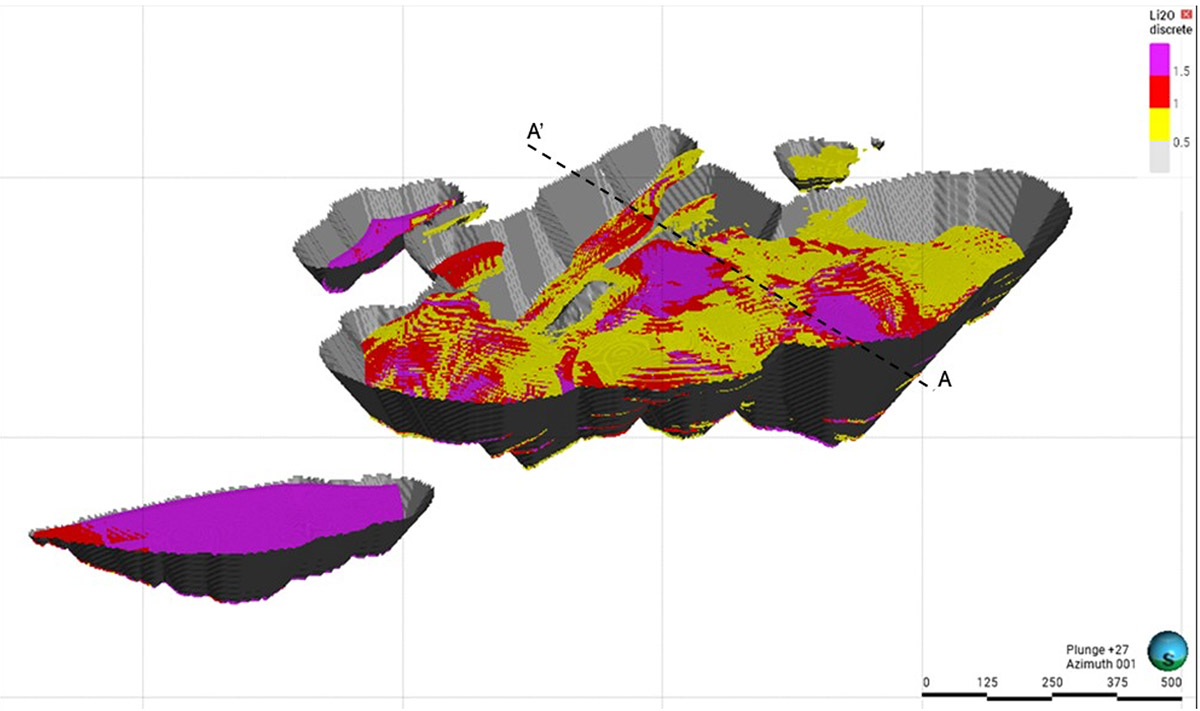

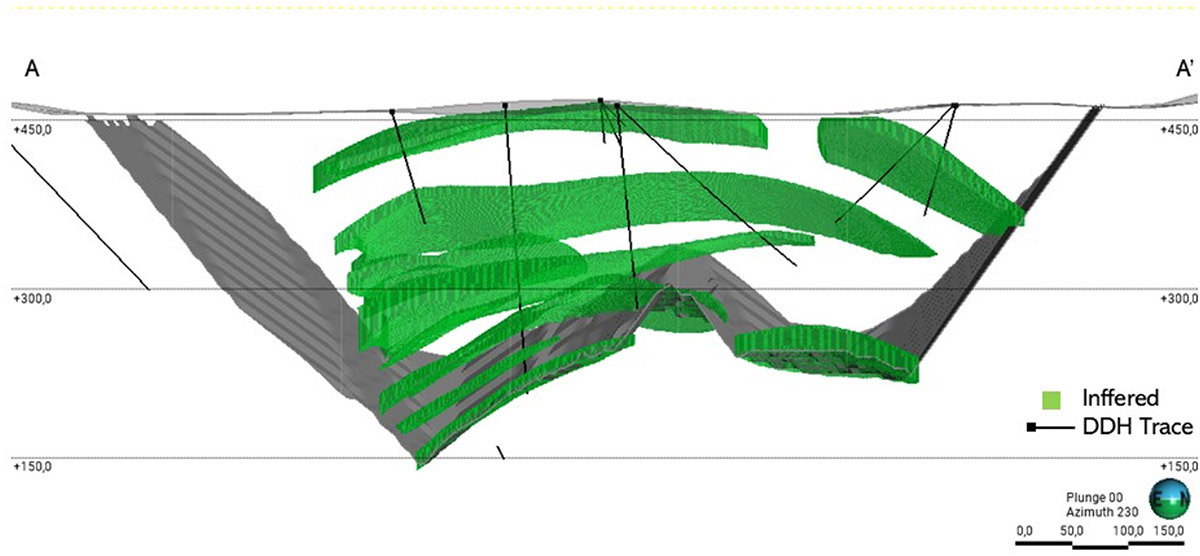

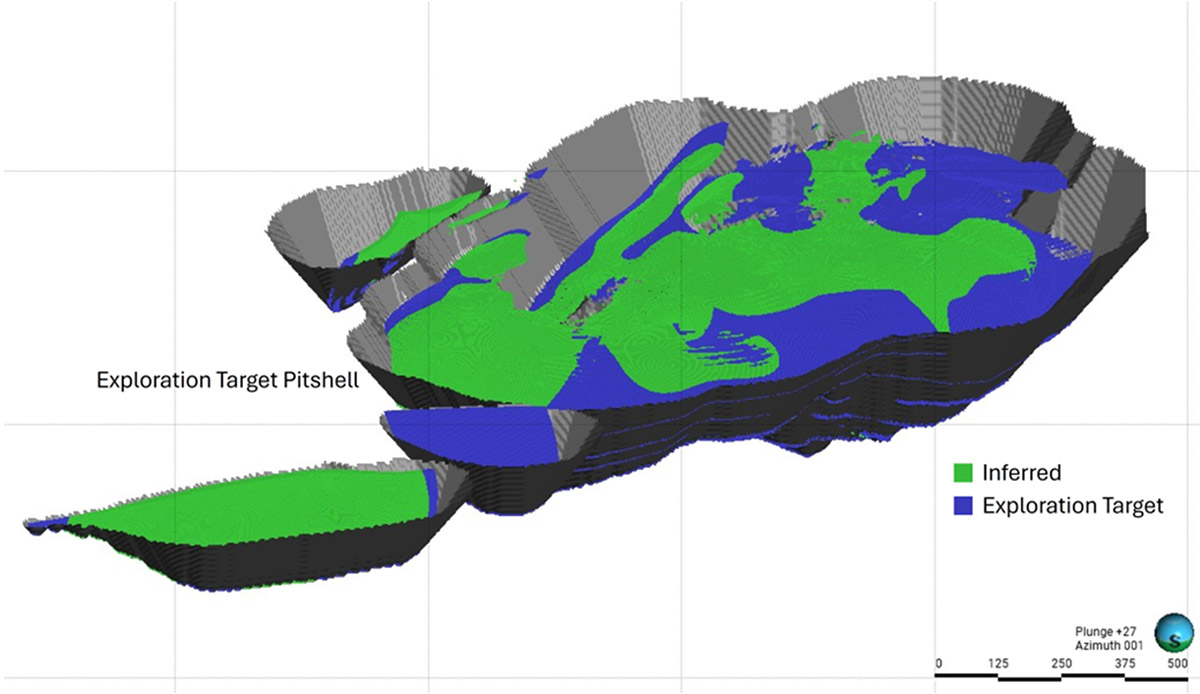

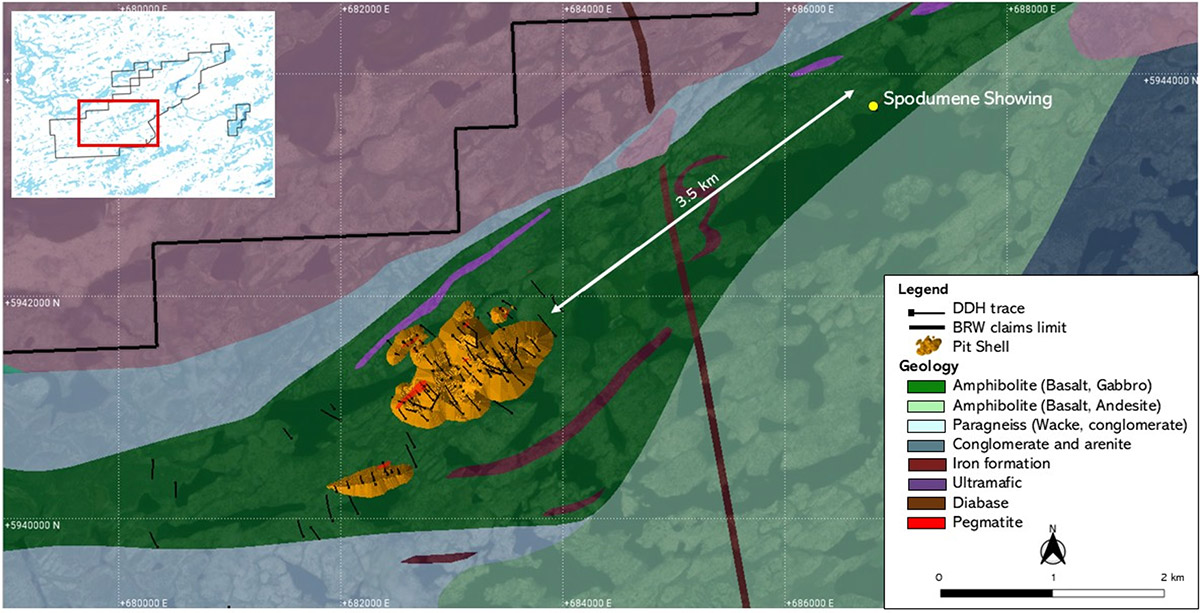

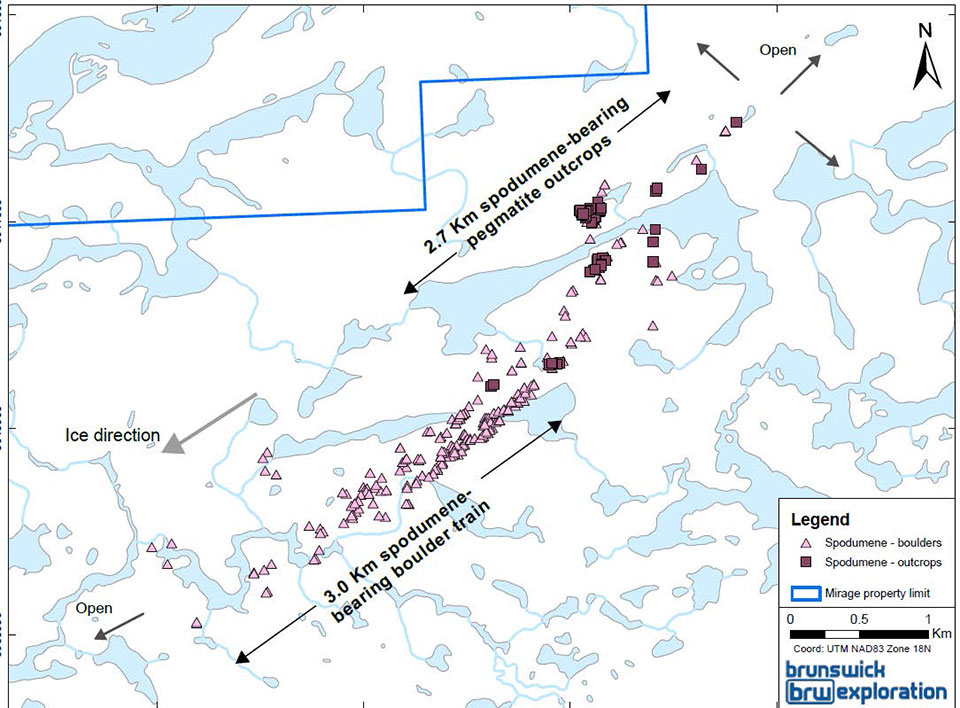

The Mirage Project is a wholly owned flagship lithium exploration asset of Brunswick Exploration Inc. It comprises 278 claims with a total surface area of 13 839 hectares (staked and optioned claims), located roughly 40 kilometers south of the Trans-Taiga Highway in Quebec’s James Bay region. In the summer of 2023, Brunswick Exploration discovered serval high-grade spodumene bearing pegmatite outcrops on the property. These outcrops are on a 6 kilometers long trend which remains open in all directions (see June 14th, 2023 press release). Exploration and diamond drilling on the Mirage project is ongoing since then and has so far delineated nine main spodumene pegmatite dykes, which were named MR-1 to MR-9. Drilling highlights include 93.45 meters at 1.55% Li2O and 69.3 meters 1.64% Li2O both at MR-6 (see May 8 and June 4 2024 Press Releases).